Senator Murray: “I pushed hard for the Administration to address the harm these failures have caused, and I’m relieved that today they heeded my call to finally accurately count payments borrowers have made over decades—which will provide immediate debt relief for thousands and bring millions more closer to relief.”

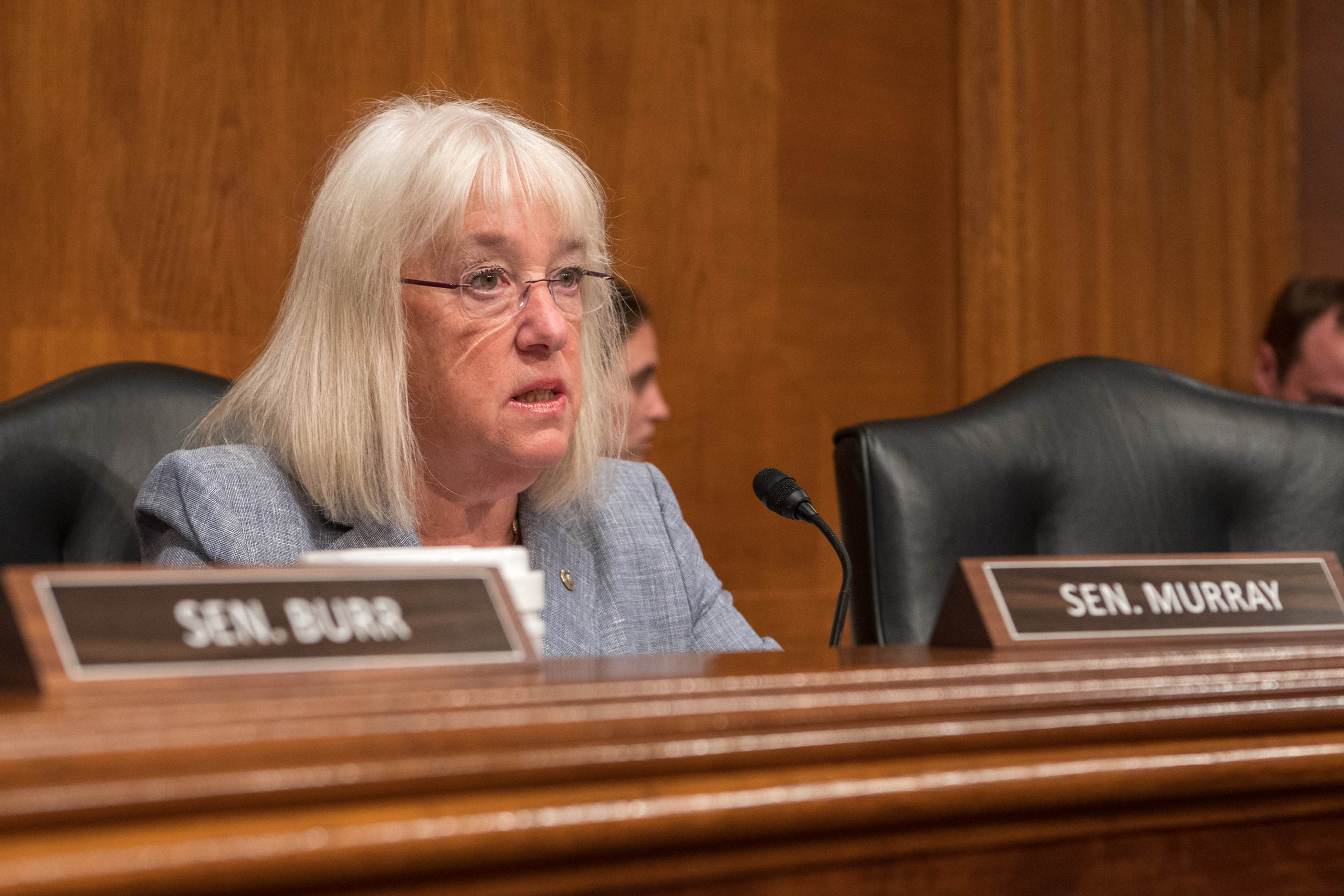

(Washington, D.C.) – Today, U.S. Senator Patty Murray (D-WA), Chair of the Senate Health, Education, Labor, and Pensions (HELP) Committee, released the following statement on the Biden Administration’s announcement of a retroactive payment correction for the income-driven repayment (IDR) system—which a recent NPR investigation showed is failing the more than 9 million borrowers currently enrolled, by neglecting to ensure qualifying payments are counted towards loan discharge. Specifically, the report found that because of administrative failures to track payments and paperwork errors during loan transfers, borrowers are being denied IDR discharges even after decades of repayment. In particular, borrowers with low incomes who are eligible for zero-dollar payments are not having those payments adequately tracked.

“This is pretty simple: our income-driven repayment system should make sure borrowers have a monthly payment that doesn’t break the bank and provide borrowers a reliable path to getting their loans discharged. But it’s clear that for too long, the system has been failing borrowers—and they’ve instead been saddled with ballooning debts and false promises. Instead of a functioning system where borrowers’ monthly payments count towards discharge, payments aren’t being accurately tracked—and it’s borrowers with the tightest budgets who are harmed the most and are often trapped in repayment through no fault of their own. It’s absolutely unacceptable.

“I pushed hard for the Administration to address the harm these failures have caused, and I’m relieved that today they heeded my call to finally accurately count payments borrowers have made over decades—which will provide immediate debt relief for thousands and bring millions more closer to relief—and crack down on servicers wrongly steering borrowers towards forbearance instead of putting them on a path to relief. This is going to make a huge difference in the lives of so many borrowers in Washington state and across the country, and it’s an urgently-needed step in the right direction. Next, we’ve got to fix the income-driven repayment system once and for all—so I continue to urge the Biden Administration to finalize a new, more generous IDR plan for all borrowers, and to extend the payment pause until 2023 to get this done.”

Today’s announcement will help correct administrative failures that have led to borrowers missing out on progress toward public service loan and IDR forgiveness. At least 3.6 million borrowers will move closer to IDR forgiveness and 40,000 borrowers will receive immediate Public Service Loan Forgiveness (PSLF).

Specifically, these actions include:

- addressing forbearance steering by retroactively counting long-term forbearances toward IDR and PSLF forgiveness and providing a path for borrowers steered into shorter-term forbearances to seek additional relief;

- correcting historical failures in tracking IDR payments for Direct Loans and federally-managed Federal Family Education Loans (FFEL) by counting payments regardless of payment plan, payments made prior to consolidation and on consolidated loans, and almost all months in deferment prior to 2013 toward IDR forgiveness; and

- addressing accurate payment counting moving forward through increased oversight of forbearance steering, new guidance to loan servicers and a commitment to begin to display IDR payment counts so that borrowers can track their progress toward IDR forgiveness beginning in 2023.

Importantly, today’s announcement improves the safety net for borrowers with low incomes who rely on IDR to make affordable payments on their student loan debt while having a reliable pathway out of perpetual repayment. This announcement also builds on the work of the Biden Administration to cancel more than $17 billion in student loan debt for 725,000 borrowers.

The announcement comes after a call from Senator Murray and Representative Bobby Scott urging the Administration to issue a retroactive IDR payment correction that would, at a minimum, count all months that a borrower has been in repayment as qualifying months toward IDR discharge regardless of payment plan, loan type, prior default or delinquency, or time spent in deferment or forbearance; provide—to the greatest extent possible—automatic benefits to borrowers who have been harmed; and, for borrowers who may need to consolidate their loans to access discharge, give borrowers a minimum of one year to take the steps necessary to become eligible.

###