The RESOURCES Act would give servicemembers and their families a fair shot at accessing retirement benefits that they’re entitled to and bolster financial training efforts within the armed services

More than half of military and veteran families are unprepared for a financial emergency or a significant loss of income – MORE HERE from the Military Family Advisory Network

Senator Murray: “The last thing the women and men bravely serving our country, and their families, should have to worry about is how they’ll make ends meet once they finish their service.”

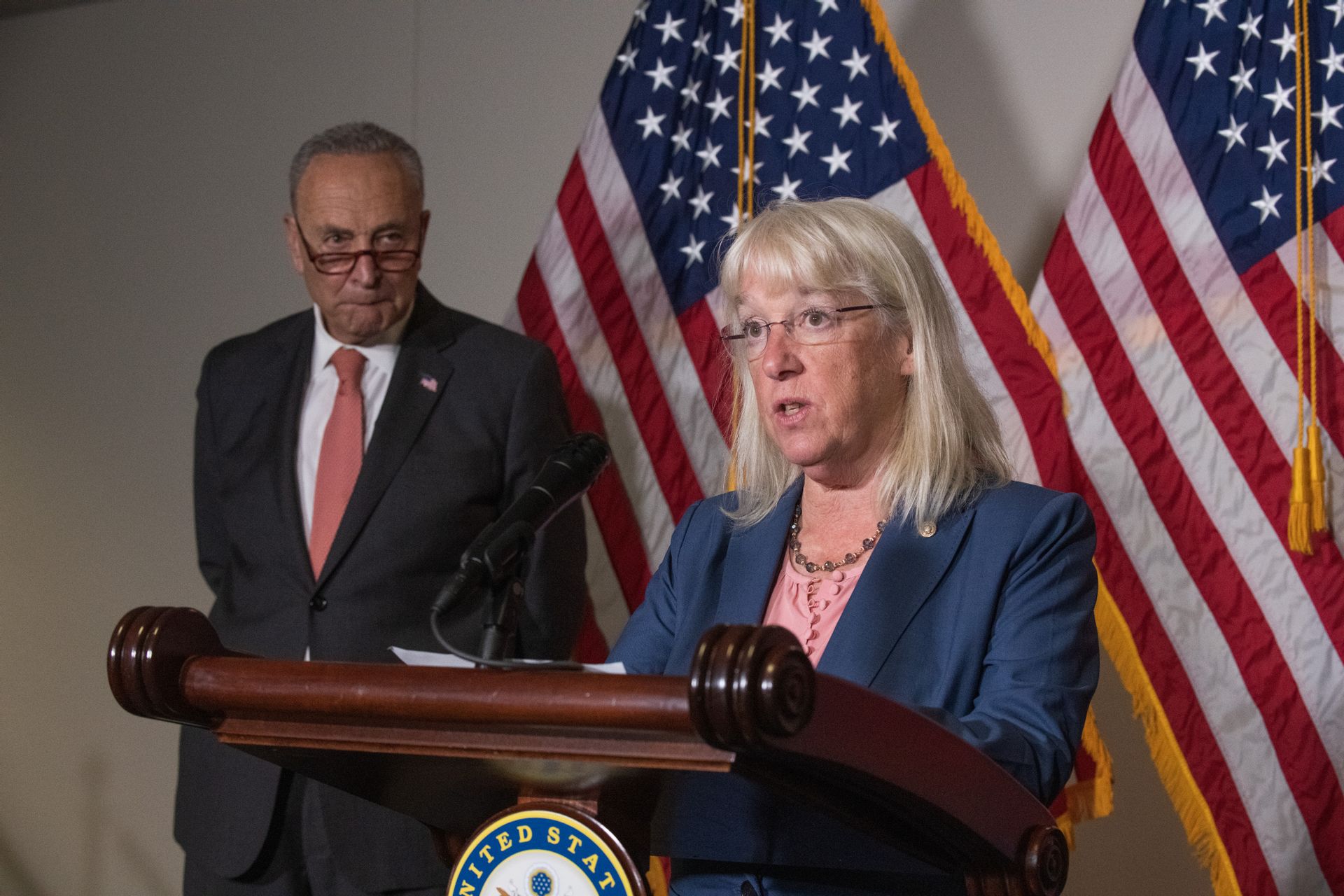

(Washington, D.C.) – U.S. Senator Patty Murray (D-WA), a senior member of the Senate Veterans’ Affairs Committee, today re-introduced the Re-Open Enrollment for Servicemembers to Opt-In to Updated Retirement Choice for Enduring Security (RESOURCES) Act—legislation that would promote financial security for military families by improving financial training and re-opening the enrollment period for certain members to opt-in to the military’s Blended Retirement System (BRS). Senator Murray first introduced the bill in 2020.

“The last thing the women and men bravely serving our country, and their families, should have to worry about is how they’ll make ends meet once they finish their service. But right now, too many of our servicemembers don’t have the financial support they need to succeed,” said Senator Murray. “My RESOURCES Act is a crucial step we must take for military families in Washington state and across the country to ensure that they have all of the necessary tools, opportunities, and knowledge to not only manage their current financial situations, but also effectively plan for their futures.”

According to a 2019 Military Family Advisory Network (MFAN) survey, more than half of military and veterans’ families are unprepared for a financial emergency or a significant loss of income, and nearly a quarter of respondents had no practical or viable plan of action for seeking assistance in a financial emergency. For active duty military, this financial stress can have a direct impact on mission readiness, and for veterans, experiencing even relatively minor financial problems has led to an increased likelihood of experiencing homelessness. Additionally, the COVID-19 pandemic has only served to exacerbate these issues, and places even greater importance on short- and long-term financial security for servicemembers and their families.

While the Department of Defense (DoD) has taken some important steps to address the financial challenges that servicemembers and their families face, Senator Murray has advocated for more action to help military families achieve financial security. For example, the Blended Retirement System (BRS) available to servicemembers, made law through the fiscal year 2016 National Defense Authorization Act, was an important development in helping members of the military and their families save for the future. Prior to the BRS, in order for servicemembers to collect retirement, they had to serve at least 20 years, which historically has led to only 19% of active duty servicemembers ultimately receiving retirement funds.

When given the option to switch to the BRS when it was introduced, most of those eligible did not enroll, despite the fact that it would be the more financially sound retirement option for them. According to Stars and Stripes, for eligible servicemembers in the active duty component, only 25% of the Army, 29% of the Air Force, and 32% of the Navy opted in to the BRS, and for the reserve components, only 10% of eligible Army reservists, 11% of Air Force reservists, and 11% of Navy reservists opted in. In stark contrast, the Marine Corps, which required each eligible servicemember to make an affirmative decision on which retirement plan they wanted, as opposed to the other services that defaulted servicemembers into the legacy retirement system unless they indicated otherwise, had over 59% of eligible active duty Marines opt in to BRS, and 39% of eligible of reservists opt in.

According to the Government Accountability Office (GAO) report, which Senator Murray requested, and testimonies from financial counselors, servicemembers, and their families, a significant reason that so many servicemembers did not opt in to the BRS was a lack of adequate and effective outreach and training about its benefits. This is reinforced by the 2019 MFAN survey, in which over 44% of survey respondents did not know which retirement plan they had chosen. Of those respondents, 26.4% would change retirement plans if given the option.

To that end, in order to help strengthen the financial readiness and resiliency of military families and improve access to the BRS, the RESOURCES Act would:

- Establish a new election period for the BRS.

- Require additional, improved training on the BRS.

- Expand and enhance other financial training available to servicemembers and their families.

- Create a DoD Advisory Council on Financial Readiness.

- Enact additional disclosures and greater transparency surrounding lump sum payments.

“As an organization, we have seen the complexities around finances and achieving financial health for military families,” said Shannon Razsadin, president and executive director for Military Family Advisory Network (MFAN). “This rings true on the issue of retirement, a topic that can seem out of reach for many families, especially those who are working to make ends meet. In 2019, through our Military Family Support Programming Survey, we were shocked to learn that nearly half of the respondents – primarily military spouses who often manage the family finances – were unaware of the retirement plan they were enrolled in. Re-opening the Blended Retirement System enrollment would provide a significant opportunity for dialogue among spouses about financial planning. And, organizations like MFAN are ready to support with the critical education that is needed for the whole family around this topic.”

“In 2018, when the legacy military retirement system was replaced with the new Blended Retirement System (BRS), a majority of eligible service members with fewer than 12 years of service either did nothing or elected to remain in the old system. History tells us both decisions will lead to the same result: over 80 percent of those veterans will separate prior to 20 years and the legacy system will entitle them to no retirement benefits. The Association of Military Banks of America is proud to support the RESOURCES Act introduced today by Senator Patty Murray. This legislation will provide a large group of service members and their families a second chance to make a retirement benefits decision that is right for them. Senator Murray has incorporated the lessons learned from the original 2018 enrollment period in a new approach that promises to offer each eligible service member a more informed choice,” said Maj Gen (Ret.) Steven J. Lepper, USAF, President & CEO, Association of Military Banks of America. “This legislation also ensures that, going forward, all our military families will benefit from the best financial education and resources available from the public and private sectors. AMBA and our member military banks look forward to a renewed public-private partnership focused on the financial readiness of our Nation’s armed forces.”

The daughter of a World War II veteran and the former head of the Senate Veterans’ Affairs Committee, Senator Murray has long been a champion for servicemebers, veterans, and military families in Washington state and across the country. Previously, Senator Murray has secured a dedicated line of funding for military child care center construction that will pave the way for more than $120 million in critical federal investments to increase vital access to child care across all the services and ensure families are getting the support they need to succeed. Additionally, she has successfully worked to expedite federal hiring processes for military spouses, and bolster outreach to servicemembers, veterans, and their families so they know about the resources and programs, including financial training programs, that they may already have access to.

Read a breakdown of the RESOURCES Act HERE.

Read the bill text HERE.

###